Navigating the Facility Globe of Business Development: Insights and Strategies

Starting the trip of developing a company can be an overwhelming task, specifically in a landscape where policies are regularly progressing, and the stakes are high. As business owners laid out to navigate the detailed globe of company formation, it comes to be crucial to outfit oneself with a deep understanding of the elaborate nuances that specify the procedure. From choosing one of the most suitable company framework to guaranteeing rigid legal conformity and designing effective tax planning techniques, the path to creating a successful service entity is riddled with complexities. Nonetheless, by unwinding the layers of intricacies and leveraging insightful strategies, business owners can lead the way for a solid foundation that establishes the phase for future growth and sustainability.

Business Framework Choice

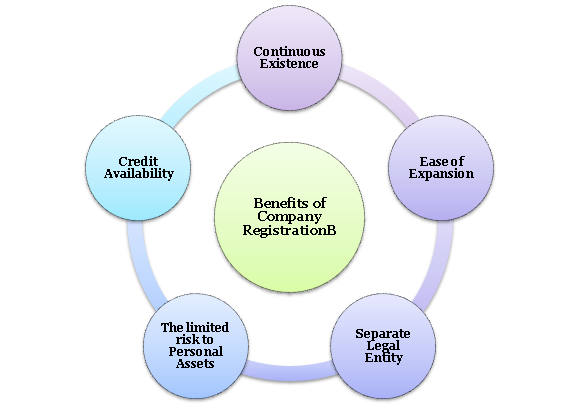

In the world of company development, the critical choice of selecting the proper service framework lays the structure for the entity's legal and operational framework. The selection of service framework considerably impacts numerous elements of the company, including taxation, responsibility, monitoring control, and conformity needs. Entrepreneurs must very carefully assess the available alternatives, such as single proprietorship, partnership, limited obligation firm (LLC), or corporation, to establish the most suitable framework that straightens with their service goals and conditions.

One typical framework is the single proprietorship, where the company and the owner are taken into consideration the same legal entity. Comprehending the subtleties of each business framework is essential in making a notified choice that establishes a strong groundwork for the company's future success.

Legal Conformity Essentials

With the structure of an appropriate service framework in location, making certain lawful conformity fundamentals comes to be vital for safeguarding the entity's operations and maintaining regulative adherence. Legal conformity is crucial for firms to run within the limits of the legislation and prevent lawful issues or possible fines. Secret legal compliance essentials consist of acquiring the necessary permits and licenses, sticking to tax obligation laws, carrying out correct information defense actions, and abiding with labor legislations. Failure to abide by lawful needs can lead to fines, claims, reputational damages, or perhaps the closure of business.

To ensure lawful conformity, firms ought to frequently examine and update their procedures and plans to mirror any kind of adjustments in regulations. It is likewise vital to inform employees concerning conformity needs and offer training to alleviate risks. Seeking legal advise or compliance experts can additionally help business navigate the intricate lawful landscape and keep up to day with developing laws. By prioritizing lawful compliance essentials, organizations can build a strong structure for lasting growth and long-lasting success.

Tax Obligation Preparation Factors To Consider

Additionally, tax preparation ought to encompass techniques to capitalize on offered tax reductions, incentives, and credits. By tactically timing earnings and costs, organizations can potentially decrease their taxable revenue and overall tax obligation problem. It is additionally vital to remain educated regarding adjustments in tax regulations that may affect the company, adapting methods accordingly to stay tax-efficient.

Additionally, worldwide tax planning considerations might emerge for organizations running throughout borders, involving intricacies such as transfer prices and foreign tax credit histories - company formation. Seeking support from tax obligation experts can assist browse these intricacies and create a detailed tax obligation plan tailored to the firm's needs

Strategic Financial Monitoring

Effective financial management entails a detailed technique to supervising a business's financial sources, financial investments, and total financial wellness. By creating comprehensive spending plans that straighten with the business's goals and goals, companies can allocate sources useful site effectively and track efficiency against economic targets.

Checking money inflows and discharges, handling working capital successfully, and making certain adequate liquidity are necessary for the everyday operations and long-term feasibility of a company. By identifying financial risks such as market volatility, credit scores threats, or governing modifications, companies can proactively carry out steps to safeguard their financial security.

Additionally, monetary coverage and analysis play an visit the site essential duty in tactical decision-making. By producing accurate economic reports and carrying out thorough analysis, companies can acquire useful insights into their economic performance, identify areas for enhancement, and make educated critical options that drive sustainable development and earnings.

Growth and Growth Methods

To move a company in the direction of enhanced market visibility and success, critical development and development methods should be thoroughly devised and implemented. One effective approach for development is diversification, where a business goes into brand-new markets or offers brand-new items or services to lower risks and take advantage of on arising opportunities. It is important for firms to conduct comprehensive market research study, economic analysis, and danger assessments before beginning on any development strategy to guarantee sustainability and success.

Verdict

Finally, browsing the complexities of firm development calls for careful factor to consider of company framework, legal conformity, tax planning, financial management, and development methods. By tactically picking the ideal service structure, guaranteeing lawful compliance, preparing for tax obligations, handling financial resources efficiently, and carrying out development techniques, firms can set themselves up for success in the affordable company setting. It is necessary for organizations to approach company formation with a strategic and thorough my website way of thinking to achieve long-term success.

In the realm of business formation, the critical choice of picking the suitable service framework lays the foundation for the entity's legal and operational framework. Entrepreneurs must meticulously assess the readily available alternatives, such as sole proprietorship, partnership, limited obligation company (LLC), or company, to identify the most ideal framework that aligns with their business goals and circumstances.

By creating detailed spending plans that align with the firm's objectives and goals, companies can assign sources effectively and track performance against monetary targets.

In verdict, navigating the complexities of firm development requires mindful consideration of company framework, legal compliance, tax preparation, financial management, and growth strategies. By strategically picking the best organization framework, guaranteeing lawful compliance, planning for tax obligations, managing financial resources successfully, and implementing growth techniques, firms can establish themselves up for success in the competitive service environment.

Comments on “Recognizing the Duty of the Commercial Registration Electronic System in Modern Company Formation”